UK Energy Market Subsidies

Environmental Audit Select Committee Inquiry:

UK Energy Market Subsidies

- Summary of Conclusions and Recommendations

1.1 The overarching conclusion of this submission is that Britain gets poor value from the elaborate web of energy market subsidies it operates; subsidising the past rather than the future, old technologies rather than new, the unsustainable rather than the sustainable, and a closed cartel in preference to a more open energy democracy. The current subsidy framework acts as a roadblock to market transformation, rather than a pathway to it.

1.2 Energy market subsidies should be measured against their ability to transform rather than maintain. All energy market subsidies (including tax exemptions and credits) are market distorting. This is neither a vice nor a virtue. What matters is their contribution to market transformation.

1.3 Subsidies should be treated as transitional mechanisms rather than permanent support; addressing market defects and moving the energy market from its current structure towards the energy systems that will replace it.

1.4 Transformational subsidy policies should therefore

– be targeted towards new technologies rather than established ones

– have built-in ‘degression’ rates, offering diminishing rates of support, towards full market viability,

– prioritise renewable over non-renewable energy systems

– require all technologies to cover their own environmental clean-up costs

– be consistent with government carbon reduction targets

– maintain social cohesion and resilience, and

– deliver a more open, democratic and sustainable UK energy system.

1.5 The current UK approach to energy market subsidies does not constitute any such market transformation strategy.

2 Background

2.1 The issue of energy market subsidies is certainly political, but it is not ideological. Every government on the planet uses energy market subsidies. Parties of all political hues are locked into energy market subsidies. Even the most ardent champions of deregulated, competitive markets like to make exemptions for their own chosen dependencies.

2.2 Confusion only arises when less-than-honest distinctions are drawn between visible and concealed subsidies; between the use of public spending (of taxes raised) and revenues forgone (in exemptions/credits/accelerated capital depreciation rates, etc). Whatever strategies are pursued, the public ultimately pays. The critical questions revolve around whether the public (society/the planet) gains or loses from the chosen intervention strategies.

2.3 To take a balanced view of the way in which current subsidies impact on overall UK energy policy, the Committee needs to examine energy market subsidies in their broadest context; including both visible and less visible support mechanisms, and incorporating a wider appraisal of their economic and environmental impact; something the Treasury appears constitutionally unable to do.

3 Methodologies

3.1 To be fair to government, there is no international consensus about what constitutes an energy subsidy, let alone any meaningful distinction between what is market distorting and what is market transforming.

3.2 International attempts – by the Institute for Sustainable Development (2010), the World Bank (2010), the OECD (2012), and the IMF (2013) – to evaluate the impact and trade-distorting effects of different subsidy regimes all flounder upon the lack of an agreed view on how direct and indirect subsidies should be judged, let alone measured.

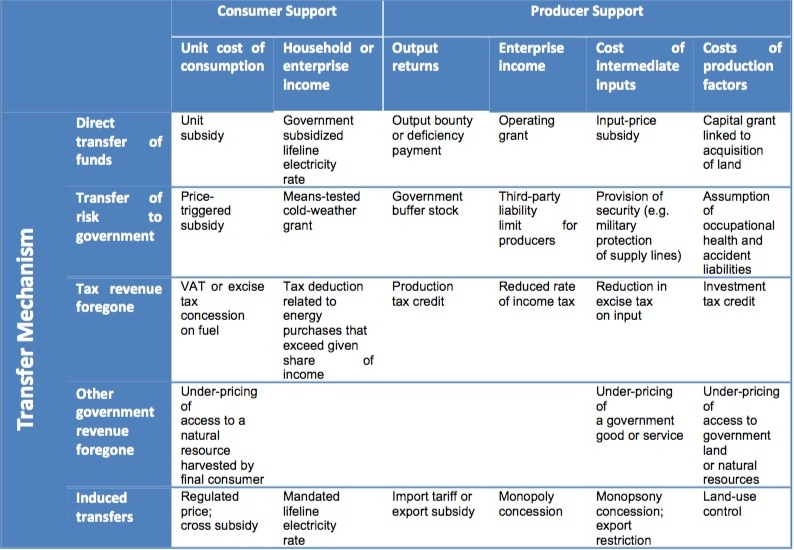

3.3 The OECD study did, however, set out a useful framework (below) of the conventional elements that constitute consumer and producer subsidies. Although limited by a narrow concept of energy (separated from its broader impact on the economy and the environment), it does at least recognise the complexity of both producer and consumer subsidies that are wrapped into existing market support mechanisms –

Source: OECD (2010) Measuring Support to Energy

3.4 The value of this table is that it acknowledges that energy market subsidies run far wider than just ‘price support’ measures going directly to the public (i.e. as Winter Fuel Payments or reduced VAT rates on fuel).

3.5 Parliament has just voted to create a separate welfare state for new nuclear power, guaranteeing it a market and price for the next 35-40 years. It will be a subsidy (in all probability to a si  ngle monopoly supplier) that exceeds all other energy subsidies. It also comes on top of the annual taxpayer contribution of £2.3bn for nuclear waste disposal, the £5bn bailout of British Energy in 2005, and government underwriting of insurance liabilities (in excess of £1.2bn) for any nuclear accident. These are barely recognised in the current ‘subsidy’ debate.

ngle monopoly supplier) that exceeds all other energy subsidies. It also comes on top of the annual taxpayer contribution of £2.3bn for nuclear waste disposal, the £5bn bailout of British Energy in 2005, and government underwriting of insurance liabilities (in excess of £1.2bn) for any nuclear accident. These are barely recognised in the current ‘subsidy’ debate.

3.6 Whilst Japan is beginning to calculate the full depth and duration of such costs, no similar comparison is being made with the long term costs and consequences of existing UK nuclear subsidies. Contracts for Difference (CfDs) and New Investment Instruments, in the current Energy Bill, will add further subsidies to the only energy sector on a spiralling ‘construction cost’ curve.

3.7 Whilst the Stern Report made a stab at evaluation of environmental damage, its greater message was about the urgent need to address the market failure (of increasing carbon emissions) in existing UK energy policies and subsidy regimes. It was a message Britain quickly chose to ignore.

3.8 Some of the new incentives the Treasury seems determined to offer to the extraction of ‘unconventional’ gas deposits (Fracking) would turn Stern’s alarm bells into sirens.

4 Current breakdown of UK energy subsidies

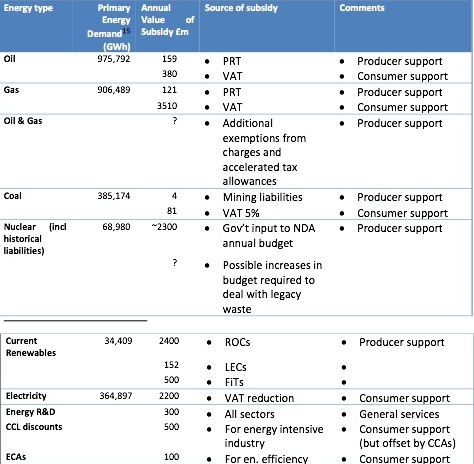

4.1 The Committee has already been given a reasonable outline of current UK energy market subsidies by Oxford Energy Associates –

(Source: Oxford Energy Associates, 2013)

4.2 Even though this breakdown does not address the full OECD checklist of intervention measures, it is clear that the Government puts over £15bn of annual subsidies into its energy sector, over 80% of which go to old, dirty, non-renewable energy sources. The Committee might like to consider the adequacy of the current subsidy framework against the following criteria –

a) Does it promote innovation and lower energy production costs? The only parts of the energy market with rapidly falling unit costs of production are in the renewables sector (particularly solar). There is no evidence of UK subsidies to non-renewable energy delivering lower energy-production costs. The recent fall in global coal prices has had little to do with UK  support mechanisms. It derived mainly from US prices being (temporarily) driven down by cheap gas, and from a European race to use up coal quotas before the 2016 Large Combustion Plant Directive comes into effect.

support mechanisms. It derived mainly from US prices being (temporarily) driven down by cheap gas, and from a European race to use up coal quotas before the 2016 Large Combustion Plant Directive comes into effect.

b) Does it reduce dependency on taxpayer support? Again, with the exception of renewables, most of today’s intervention mechanisms invite long-term (and often increasing) public subsidy. There is, for example, evidence that despite huge existing gas subsidies, power companies are already preparing to ‘game’ the market for further support. In October 2012, Ofgem’s ‘Electricity Capacity Assessment’ noted that “Some of the most difficult issues to form a firm view on are whether new gas fired generation will be built over the next 4 years, whether gas power stations (CCGTs) that have been taken out of operation (‘mothballed’) will return, and how interconnectors will flow at times of peak demand.” (Ofgem, Electricity Capacity Assessment, 2012, p8)Energy companies claim that mothballing of existing plant (and of new planning permits) has been necessary because gas prices are too low (?!). Many suspect that, in an artificially constructed UK ‘supply crisis’ in 2014/15, utilities will seek new government subsidies to bring this plant back into operation. The channel for doing so will be payments under the Capacity Mechanism of the Energy Bill.DECC’s own Impact Assessment calculated that the Capacity Mechanism would cost£2.5bn a year in standby contracts. Experience in the USA is that some 70% of these contracts went to fossil fuel generators, with only 3% going to measures that looked at demand reduction rather than increased consumption. Additional inducements to fossil fuel generators would be a classic example of parliament again being ‘suckered’ into over-generous subsidy payments to corporate energy interests. Tougher regulatory requirements, a Strategic Reserve provision, (or the prospect of prison sentences) might be more effective ways of ‘keeping the lights on’.

c) Has it reduced carbon emissions in the energy sector? The energy efficiency and Climate Change Agreement measures in the table (above) have certainly helped reduce UK carbon emissions, as has the support given to renewable energies.

Though not recognised in the table, the former Warm Front programme directly helped reduce carbon emissions from large parts of the UK housing stock.

The nuclear waste subsidy is a legacy issue not a carbon reduction one. And fossil fuel subsidies all unambiguously promote carbon emissions.

In carbon reduction terms, the UK subsidy framework looks to be largely regressive.

In carbon reduction terms, the UK subsidy framework looks to be largely regressive.

The Committee may wish to compare UK performance with the record of greenhouse gas emissions reductions in Germany over the last decade –

d) Have the UK subsidies produced a more open and competitive energy market? No. UK energy market concentration has increased over the last decade.

e) Is there a consistent approach to environmental ‘clean up’ obligations? No. Nuclear receives a massive annual subsidy for its waste management. It also receives insurance support and long term price guarantees given to no other energy source. It is unclear whether the government will subsidise decommissioning costs relating to North Sea oil wells. No such subsidies are offered to renewables.

f) Does the subsidy framework promote innovation and market transformation? Tomorrow’s energy ‘systems’ will be smarter, more integrated and more decentralised than the one we have today. They will also be based on using less energy rather than more. UK subsidies have concentrated on increasing energy production/consumption rather than reducing the need for it.The only genuinely transformative element in the subsidy framework is to be found in the Feed-in-Tariff (FITs) payments for renewable energy. This is also the main area in which genuine innovation and competition has been taking place. It says a lot about the UK that it is also the one aspect of the energy market in which the government actively constrains growth.Whilst other EU states are seeing renewables deployment at rates of over 5GW p.a. – and with innovation rates and unit cost reductions on the same scale – the UK has opted for a fixed budget, low growth approach, missing out on most of the innovation gains being enjoyed elsewhere.It is worth noting that the UK opted to structure FITs in a way that forces it to be counted as a public subsidy. The European Court previously ruled that FITs can operate as a free-standing element within energy sector accounting … with no public subsidy whatsoever. The effect of this is to allow renewables to play a much bigger role in market transformation across the EU than is allowed in the UK. This is a good example of UK subsidies being used to limit transformational change rather than drive it.

5 Redressing the balance

5.1 All subsidy measures are market distorting or transforming. That is their purpose.

5.2 The most worrying aspect of UK energy market subsidies is just how regressive they are. Whilst high carbon, non-renewable energy sources absorb the bulk of subsidies (often uncapped), demand reduction measures are to be driven by loans. Moreover, the subsidy framework reinforces market concentration rather than dilutes it.

5.3 The UK does not have an open, competitive energy market. The ‘market’ is, in effect, an energy cartel, dominated by the Big 6 power companies, regulated around short-term price considerations, and underpinned by an elaborate (and expensive) system of corporate welfare. All attempts to broaden the ownership of energy production or distribution are fiercely resisted by the same interests. UK energy market subsidies underpin this closed energy cartel.

5.4 Yet, if you were to believe the press coverage, the UK debate about energy market subsidies is whether taxpayers/bill-payers will sink beneath an ‘unaffordable’ burden of annual (£0.5bn) Feed-in-Tariff payments for renewable energy.

5.5 None of this works in Britain’s long term interests. If the Committee is to set itself a benchmark for progressive recommendations arising from this Inquiry, then clarity, transparency, sustainability and consistency will be a far more valuable elements than ‘continuity’, in a UK approach to energy market interventions.

5.6 It isn’t just that throwing subsidies at fossil fuel, non-renewable energy sources is expensive, inefficient and climate damaging. These are yesterdays energy sources, reliant on yesterday’s energy thinking. It is a world only losers will try to live in. This is why the a shift into transformational subsidies (outlined in para 1.4) is the key to a more secure UK energy future.

(Alan Simpson is an independent advisor on energy and climate policy, currently working with Friends of the Earth (and others) on energy market transformation).